Donald Trump has repeatedly claimed that the United States is running a massive trade deficit with India, painting India as a country that unfairly benefits from trade with America. On February 13, 2025, he even exaggerated this deficit, claiming it was as high as $100 billion, and used it to justify imposing retaliatory tariffs on Indian goods. But a groundbreaking report by the Global Trade Research Initiative (GTRI) reveals a completely different story: far from losing out, the U.S. is actually enjoying a massive $35-40 billion trade surplus with India when you look beyond just goods. Trump’s narrow focus on goods trade ignores the billions of dollars flowing into American pockets from services, education, technology, arms sales, and more. Let’s break it down in simple terms to show how Trump’s narrative is misleading and why India holds a strong position in trade talks.

The Real Picture: A U.S. Surplus, Not a Deficit

According to GTRI, while the U.S. recorded a $44.4 billion trade deficit with India in goods and services for 2024-25, this number is misleading because it only accounts for physical goods and some services. Trump’s claim of a $100 billion deficit is wildly exaggerated, but even the actual $44.4 billion figure doesn’t tell the full story. When you include the money the U.S. earns from India in sectors like education, digital services, financial operations, intellectual property royalties, arms sales, and more, the U.S. isn’t losing money—it’s raking in an estimated $80-85 billion annually from India. This flips the narrative entirely, showing a $35-40 billion surplus for the U.S..

Trump’s focus on goods alone—like steel, textiles, or electronics—creates a distorted picture. He ignores the massive contributions India makes to American wealth through various sectors that don’t show up in traditional trade statistics. Let’s explore these sectors in detail to understand how the U.S. benefits and why Trump’s rhetoric is misleading.

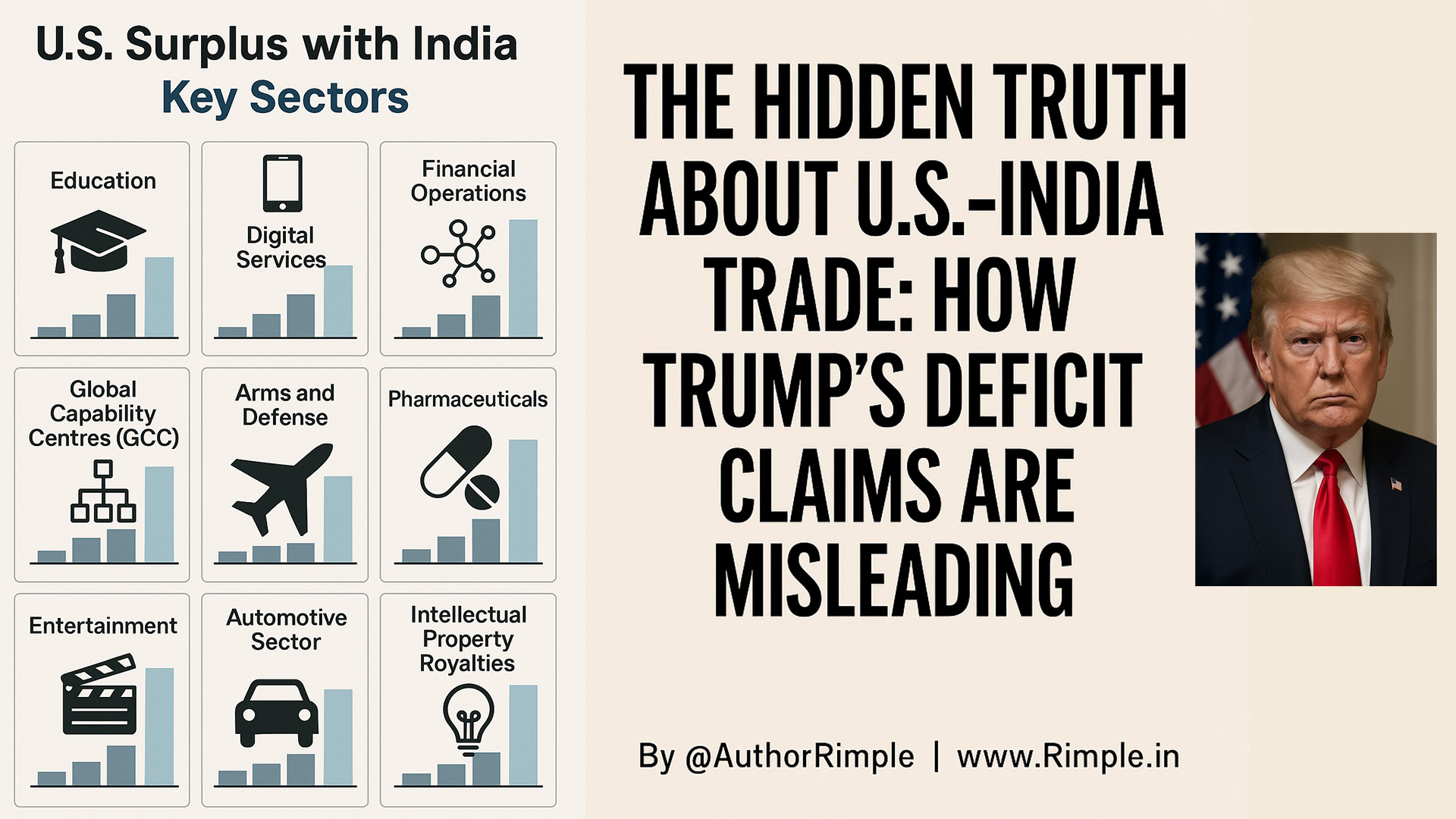

Key Sectors Fueling America’s Hidden Surplus

GTRI’s report highlights several sectors where the U.S. earns big from India, none of which are fully captured in Trump’s goods-focused trade deficit claims. Here’s a breakdown of these sectors and how much they contribute to America’s economy.

1. Education: Indian Students Power U.S. Universities

Indian students are a goldmine for the U.S. education sector. Over 300,000 Indian students study in American universities each year, spending a staggering $25 billion annually. This includes $15 billion on tuition fees and $10 billion on living expenses like housing, food, and transportation. Top universities like USC, NYU, Northeastern, and Purdue are major beneficiaries, with Indian students spending between $87,000 and $142,000 per year. This makes education one of America’s biggest “exports” to India, yet it’s completely ignored in Trump’s deficit calculations..

2. Digital Services: U.S. Tech Giants Dominate India’s Market

American tech companies like Google, Meta, Amazon, Apple, and Microsoft are cashing in on India’s booming digital market, earning $15-20 billion every year. This money comes from digital ads, cloud services, app store purchases, software sales, device sales, and streaming subscriptions. For example, Netflix alone invests $400-500 million annually in Indian content, but most of the revenue flows back to the U.S. due to limited local regulations on data and taxation. These earnings are a massive boost to American companies, but they don’t appear in goods trade statistics, making Trump’s deficit claims incomplete..

3. Financial Operations: U.S. Firms Thrive in India

American banks and consulting firms like Citibank, JPMorgan, Goldman Sachs, McKinsey, BCG, Deloitte, PwC, and KPMG are deeply embedded in India’s financial sector. They advise Indian companies, manage corporate deals, and provide high-end services, earning an estimated $10-15 billion annually. While these firms pay some taxes in India, the bulk of their profits return to the U.S., boosting American wealth. Trump’s narrative overlooks this significant revenue stream, focusing only on physical goods like cars or steel..

4. Global Capability Centres (GCCs): U.S. Companies’ Back-Office Bonanza

Global Capability Centres (GCCs) run by U.S. companies like Walmart, Dell, IBM, Wells Fargo, Cisco, and Morgan Stanley in Indian tech hubs like Bengaluru and Hyderabad generate $15-20 billion annually. These centers handle global operations in technology, finance, and analytics. While the work is done in India, the economic value is largely recorded in the U.S., as profits are funneled back to American headquarters. This is another major source of U.S. income that Trump’s goods-focused trade deficit ignores..

5. Arms and Defense: India’s Big Purchases from the U.S.

India is a major buyer of U.S. defense equipment, including fighter jets, helicopters, and other military hardware. While exact figures are often confidential, GTRI notes that these sales bring in billions of dollars annually for American defense contractors like Boeing and Lockheed Martin. India’s growing defense needs make the U.S. a top supplier, yet these earnings are not reflected in Trump’s trade deficit calculations, further skewing the narrative..

6. Pharmaceuticals: U.S. Drug Companies Profit Big

American pharmaceutical giants like Pfizer, Johnson & Johnson, and Merck earn $1.5-2 billion annually from India through patents, drug licensing, and technology transfers. These profits come from the sale of branded drugs and licensing agreements, with most of the revenue flowing back to the U.S. This sector is another example of how the U.S. benefits economically from India in ways that Trump’s goods-only focus misses..

7. Entertainment: Hollywood and Streaming Platforms Cash In

Hollywood studios and U.S.-based streaming platforms like Netflix and Disney earn $1-1.5 billion annually from India through box office revenues, subscriptions, and content licensing. Indian audiences are avid consumers of American movies and shows, and this revenue is a direct contribution to the U.S. economy. Yet, like other service sectors, it’s absent from Trump’s trade deficit math..

8. Automotive Sector: Licensing and Technical Services

American auto giants like Ford and General Motors, along with their component suppliers, earn $0.8-1.2 billion annually through licensing agreements and technical services in India. These earnings come from technology transfers and support for India’s growing automotive industry, but they don’t show up in goods trade data, further highlighting the flaw in Trump’s narrative..

9. Intellectual Property Royalties: Tech and Beyond

U.S. companies earn significant royalties from India for intellectual property, including software, patents, and other technologies. While exact figures vary, these royalties are part of the $80-85 billion the U.S. earns annually from India. Companies like Microsoft and IBM benefit from licensing their technologies, with profits flowing back to the U.S., yet this revenue is ignored in Trump’s deficit claims..

Why Trump’s Narrative Is Misleading

Trump’s focus on goods trade—items like steel, textiles, or electronics—paints a one-sided picture that ignores the broader economic relationship between the U.S. and India. By highlighting only the $44.4 billion goods and services deficit (and exaggerating it to $100 billion), he creates a false narrative that India is taking advantage of the U.S. In reality, the U.S. earns $80-85 billion annually from India across multiple sectors, resulting in a $35-40 billion surplus. This “hidden surplus,” as GTRI calls it, shows that the U.S. is a top beneficiary of its economic ties with India, not a victim..

Trump’s push for retaliatory tariffs, like the 27% tariff on most Indian goods, is based on this misleading narrative. These tariffs hurt Indian exporters and could disrupt trade, but they also risk harming American companies that rely on India’s market. For example, the $15-20 billion earned by U.S. tech giants or the $25 billion from Indian students could be jeopardized if trade tensions escalate. By ignoring the full scope of U.S. earnings, Trump’s policies seem driven more by ego than by economic reality.

India’s Strong Position in Trade Talks

GTRI’s findings give India a powerful position in ongoing trade negotiations with the U.S., which are expected to lead to a Bilateral Trade Agreement (BTA) by July 2025. Commerce Minister Piyush Goyal is leading these talks, aiming to double bilateral trade to $500 billion by 2030. India should negotiate from a position of strength, rejecting Trump’s “hollow” deficit arguments and demanding fair, balanced terms. The facts are clear: India is not just a trade partner but a major contributor to American wealth across education, technology, finance, defense, and more..

If Trump continues to push one-sided tariffs and concessions, he risks losing access to India’s massive market. American companies like Google, Microsoft, Citibank, and Boeing depend on India for billions in revenue. If trade ties sour, it’s the U.S. that stands to lose more, not India. Trump’s ego-driven approach—focused on projecting America as a victim—ignores the reality that India fuels American profits. He must put America’s economic interests first, not his personal narrative.

Also Read: